Macrs depreciation spreadsheet

Get 247 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Excel Finance Class 85 Macrs Depreciation Asset Sale Impacts On Npv Cash Flows Youtube

Enter the email address you signed up with and well email you a reset link.

. July 21 2020. Farm Bill What-If Tool. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

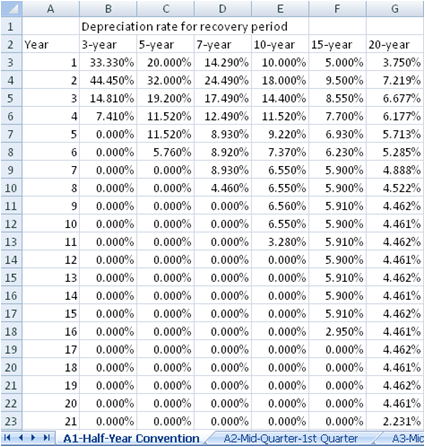

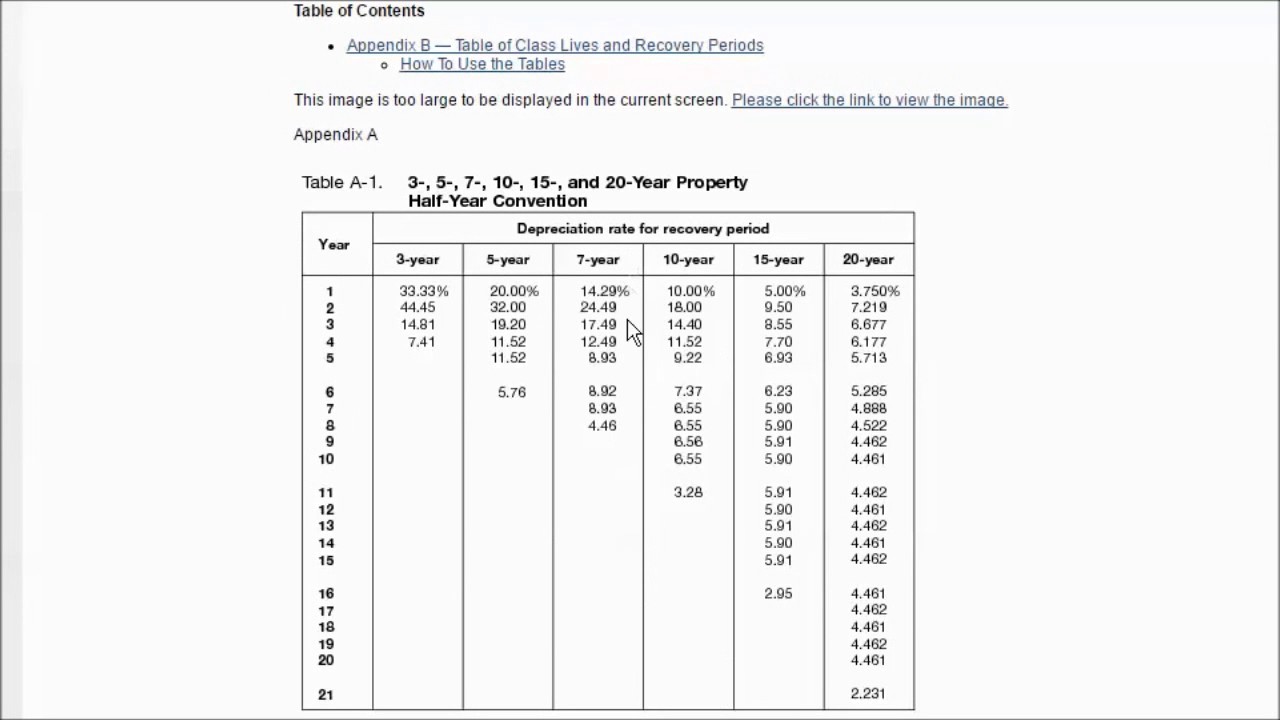

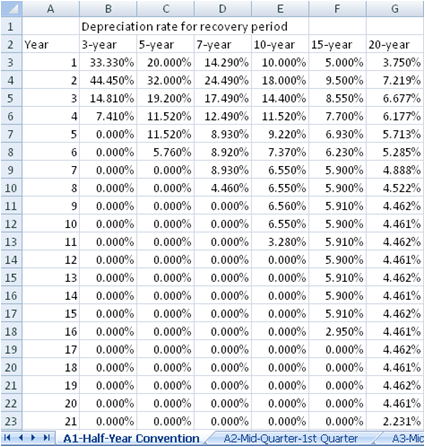

Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate.

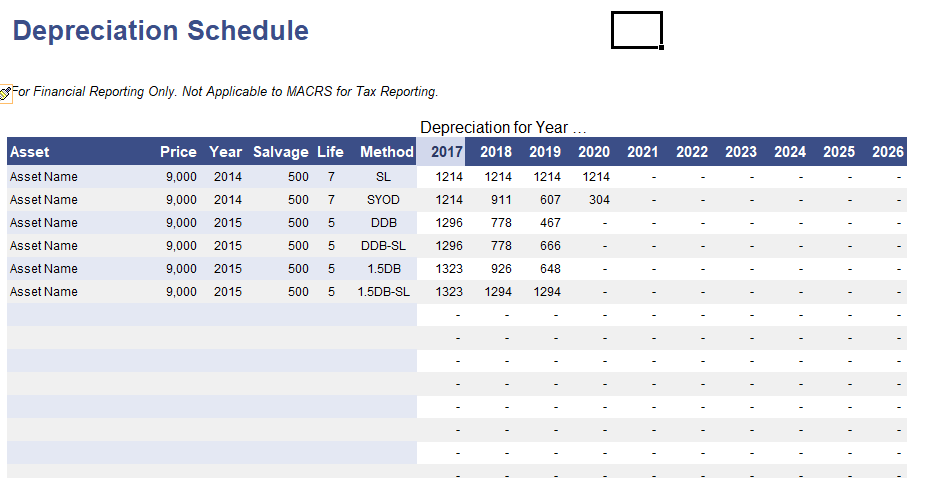

Calculates tax depreciation schedules for depreciable items. With this home appreciation calculator you are able to find out how the value of your home has changed over a time. The average car depreciation rate is 14.

Part 2 discusses how to calculate the MACRS depreciation Rate using Excel formulas. Part 3 provides a Depreciation Calculator that can be used to analyze. Assets are depreciated for their entire life allowing printing of past current and.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. This page is the first of a 3-part series covering Depreciation in Excel. You can also use it to estimate the annual appreciation rate of your home.

The Car Depreciation Calculator uses the following formulae. A graph is a kind of diagram which represents a system of interrelations or connections among 2 or more things by several distinctive lines dots bars etc. A P 1 - R100 n.

In addition the first-year allowable depreciation for each well is calculated in this spreadsheet. The firm will use the attached MACRS depreciation schedule to expense this equipment. Enter the email address you signed up with and well email you a reset link.

FAST Spreadsheet Tools. MACRS or straight-line depreciation it is theirs so make sure they understand the rules regarding depreciation and amortization. Depreciation limits on business vehicles.

Balance Sheet. 6 GAAP methods including straight-line sum of years digits and 4 declining balance methods. 24 ACRS methods including alternative ACRS and straight-line ACRS.

Although the uses of a depreciation schedule can vary from company to company as each business uses this schedule for their own purposes there are still some common scenarios to apply this schedule. Importance uses of Depreciation Schedule. D j d j C.

The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed. Evaluate each project according to the following valuation methods. Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods.

10212015 21411 PM. After creating your spreadsheet you can upload the data into Oracle Assets. Once the equipment is installed the company will need to increase raw goods inventory by 5000000 but it will.

The Eisenhower Matrix is a tool that helps businesses prioritize tasks based on their urgency and importance named after Dwight D. Eisenhower President of the United States from 1953 to 1961 the matrix helps businesses and individuals differentiate between the urgent and important to prevent urgent things seemingly useful in the short-term cannibalize. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Be informed and get ahead with. Excel spreadsheet works well. Create a valuation spreadsheet for each of the projects mentioned above.

Using the MACRS Tables. Defining a MACRS Depreciation Formula. A 7-year straight-line depreciation schedule is used.

Bonus Depreciation Section 179 Expensing Auto and Truck Limits IRS Tables option. Shown is the total amount of intangible expenses from each Partnership well investment that the partner may deduct for the tax year. D P - A.

Basis of comparison Graphs. 36 MACRS methods including regular MACRS alternative MACRS and straight-line MACRS. For assets depreciating under MACRS with a 5-year life the asset manager.

Because ABC acquired XYZ and its assets in the middle of ABCs fiscal year the asset manager at ABC needs to add assets as short tax year assets. Below are common situations when its important to create a depreciation schedule.

Depreciation Macrs Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Free Macrs Depreciation Calculator For Excel

Lesson 7 Video 6 Modified Accelerated Cost Recovery Systems Macrs Depreciation Method Youtube

Depreciation Calculator Excel Template For Free Download

Implementing Macrs Depreciation In Excel Youtube

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

9 Free Depreciation Schedule Templates In Ms Word And Ms Excel

Macrs Property Depreciation Template Visual Paradigm Tabular

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Table Excel Excel Basic Templates

How To Use The Excel Vdb Function Exceljet

How To Calculate Macrs Depreciation When Why

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Double Teaming In Excel